Which of the Following Types of Property May Be Depreciated

Due to depreciation an asset decreases in value over a period of time. If youre wondering what can be depreciated you can depreciate most types of tangible property such as buildings equipment vehicles machinery and furniture.

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

Events that can cause property to depreciate include wear and tear age deterioration and obsolescence.

. Which of the following statements about residential rental property are true. Gds for a period of 30 years. B Smalltools purchased by a business with a useful life of less than one year.

If you possess an. Can Used Property Be Bonus Depreciated. By convention most US.

In order to take advantage of property depreciation deductions the property must meet all the following requirements. Are expected to lose their value over their useful lives. When residential property is sold and sellers gain on sale is less than 250000 the seller will not have.

The following are types of tangible property that you generally cannot depreciate even though you use them in your business or hold them to produce income. Gds for a period of 40 years. If you decide to completely replace a buildings new roof you can now take an immediate deduction of up to 1040000 in 2020 for the cost of the new roof.

As a general rule a class of an asset can be depreciated over a period of time as long as the value is greater. Examples of tangible items you can depreciate include. Only the value of buildings can be depreciated.

Heres What the IRS Says. Click again to see term. All new and used properties purchased before September 27 2017 are eligible for the deduction.

You can also depreciate certain intangible property such as patents copyrights and computer software according to the IRS. Owner receives condemnation award. Essentially when something depreciates it reduces in value.

Only the apartment building as an investment property can be depreciated. SELECT ONE a A tablet used by a taxpayer who is a sole proprietor solely for personal use. C A vacation home.

Will usually be depreciated depreciate each separately usually over 5 years for a rental property. You cannot depreciate land. 13 Cost recovery is a term most closely related to.

Types of Property That Are Depreciable. You can never depreciate the cost of land because land does not wear out become obsolete or get used up. If you get a new roof the Section 179 deduction allows you to deduct the cost of it.

You can alsodepreciate certain intangible property such as patents copyrights and computer software. Ads for a period of 30 years only by electing to in the first year the property is placed in service. Property in California is 39 year old and consists of a real estate house and an office furniture house and its vehicles and trucks are 5 year old.

The depreciable amount is depreciatedallocated on. Tap again to see term. The following annual rates of depreciation shall be applied to the different types of personal property indicated.

Which one of the following types of property can be depreciated. Personal residence When residential property is sold and the sellers gain on the sale is less than 250000 the seller will not have to pay taxes on the transaction if. Have a limited useful life.

Posted at 1835h in Properties by Carolyn 0 Comments. Assets over 200 are depreciated you may qualify for a special election to increase that amount if the item or asset has a useful life over 1 year. Buildings are therefore depreciated just as in the case of other PPE items.

Which of the following properties cannot be depreciated. If the property is classified as property plant and equipment PPE land is there not depreciated but the buildings are. 1 All personal property not otherwise listed in this depreciation schedule shall be depreciated at 10 percent per year.

Cars trucks boats etc. Which of the following represents an involuntary conversion. To be depreciable the property must meet all the following requirements.

Which of the following types of property may be depreciated. Asset classes have been defined according to tax law. Aside from land most tangible property of a certain value and function can be depreciated on your tax return over the course of several years.

D A copier purchased by a tax preparation office. Buildings machinery vehicles furniture and equipment. A homeowner may deduct from income tax liability.

You can depreciate most types of tangible property except land such as buildings machinery vehicles furniture and equipment. The property may be depreciated using the. Ads for a period of 27 12 years only by electing to in the first year the property is placed in service.

Tap card to see definition. Depreciation is a loss in the value of property over the time the property is being used. Your car computer or rental property are all examples of depreciable property.

2 Except as provided in B10 of this regulation long-lived electric generation machinery and equipment of nonutility entities that. Click card to see definition. There is a 50 reduction of bonus depreciation each year until 2026 when it has ended.

Residential rental property is depreciated at a rate of 3636 each year for 275 years. Although a business can use physical properties such as buildings vehicles furniture and equipment for several years they do not last forever. Most types of tangible property except land are depreciable eg.

How Does Rental Property Depreciation Work Biggerpockets

What Can Be Depreciated In Business Depreciation Decoded

Depreciation Methods 4 Types Of Depreciation You Must Know

Eliot Lopian Insurance Coverage Available To Homeowners And Renters Homeowner Homeowners Insurance Insurance Coverage

Infographic How 203k Works Renovation Loan Center Renovation Loans Home Improvement Loans Home Renovation Loan

How To Calculate Depreciation On Rental Property

Financial Advice Financial Investment Financial Counseling Money Investment And Best Financial Advice In 2020 Investing Infographic Investing Real Estate Investing

I Chose This Image Because It Is An Example Of A Ucc 1 Which Means It Is A Formal Notice That A Li Bill Of Sale Template Financial Independence Card Templates

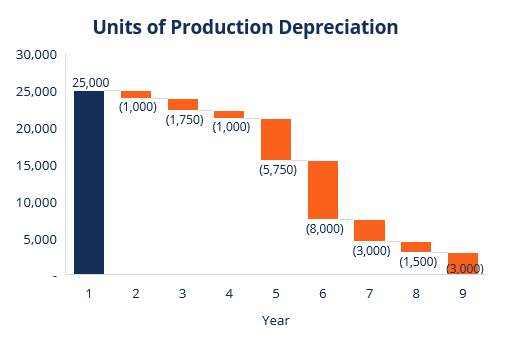

Depreciation Methods 4 Types Of Depreciation You Must Know

What Can Be Depreciated In Business

Depreciation Methods 4 Types Of Depreciation You Must Know

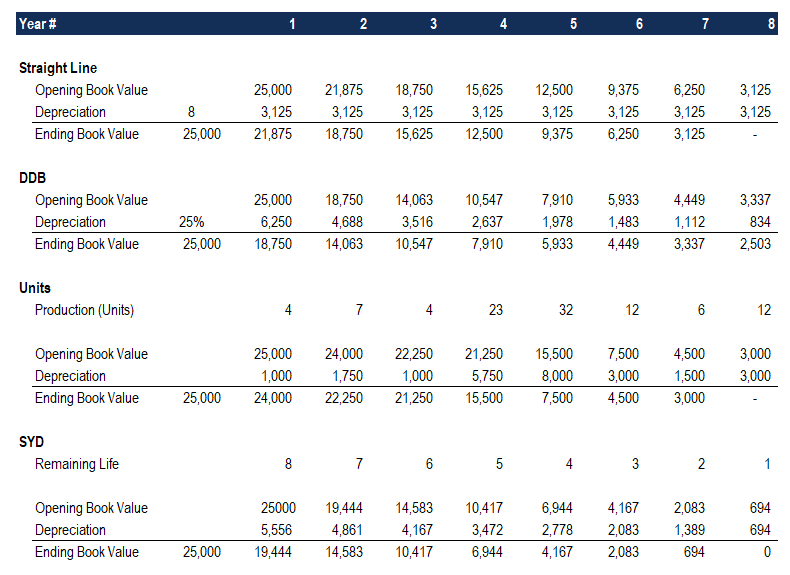

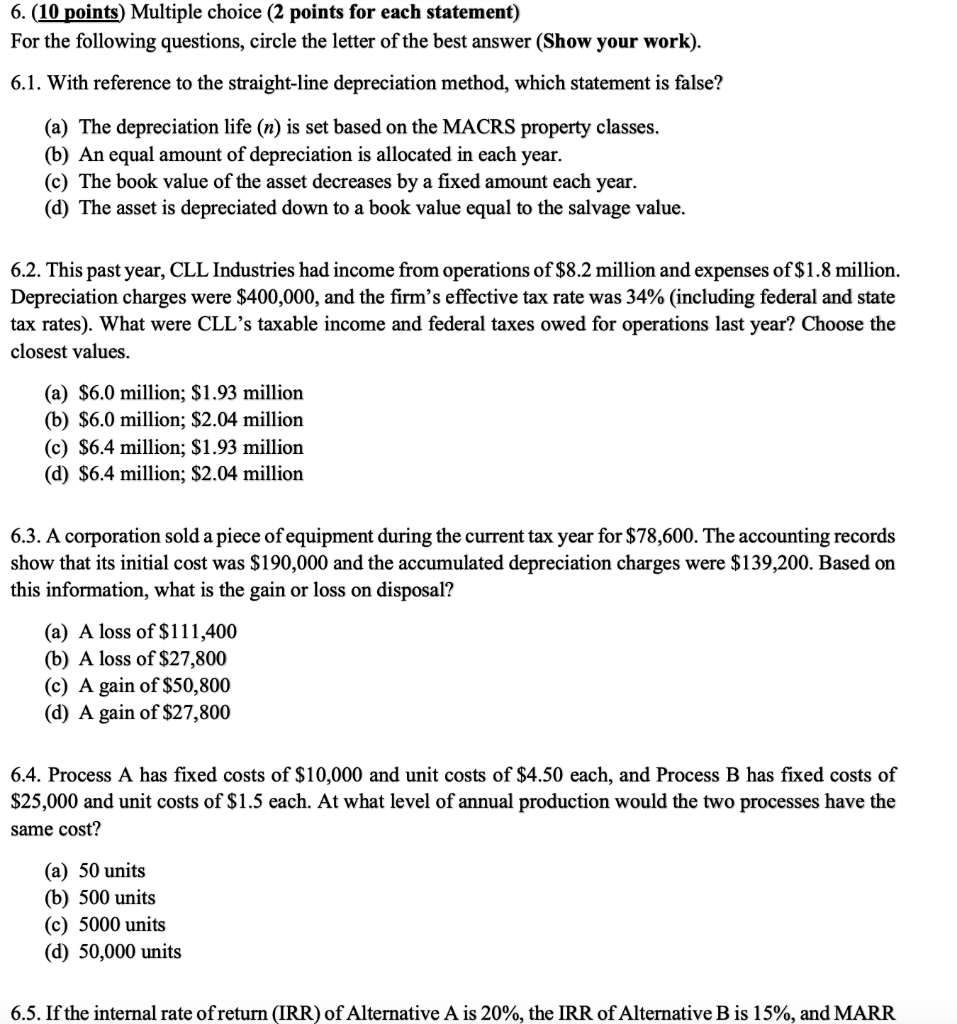

Solved 6 10 Points Multiple Choice 2 Points For Each Chegg Com

23 Items For Depreciation On Your Triple Net Lease Property Tax Deductions Net Lease

Straight Line Depreciation Formula Guide To Calculate Depreciation

Like Kind Exchanges Of Real Property Journal Of Accountancy

Depreciation Of Building Definition Examples How To Calculate

/depreciation---next-exit-road-524033056-0b86e2273334483db73ed6c98384339a.jpg)

Comments

Post a Comment